Wealth Storage for Home Inspectors

Digital wealth is wealth on paper or online. Examples of digital wealth include bank accounts, stocks, bonds, 401Ks and ETFs. Digital wealth preservation is dependent on third parties fulfilling their obligations. Counterparty risk is the possibility that some third party you do business with will not live up to its obligations.

When you have money in a bank... you actually don’t. You’ve loaned the bank your money. Your bank statement isn’t an accounting of how much money you have, but, rather, how much money you’ve loaned your bank. The bank is obligated to repay you your money upon request, and perhaps pay you a little interest for allowing them to borrow it. You are relying on your bank to fulfill its obligations and the risk of them failing to do so is the counterparty risk. You can’t touch your money at the bank, so, therefore, it is digital wealth and exposed to this counterparty risk.

Countering Counterparty Risk with Diversification

Diversification is an effective way to reduce counterparty risk. Spread out your deposits and investments over multiple banks, institutions, and locations. This will protect you from most disasters short of a national financial meltdown.

“But divide your investments among seven or eight places, for you do not know what risks might lie ahead.”

– Ecclesiastes 11:2

Now, this doesn't mean to invest in seven or eight stocks in the stock market. That's not diversification. That's putting all your eggs in one basket, one fraught with counterparty risk.

Cash

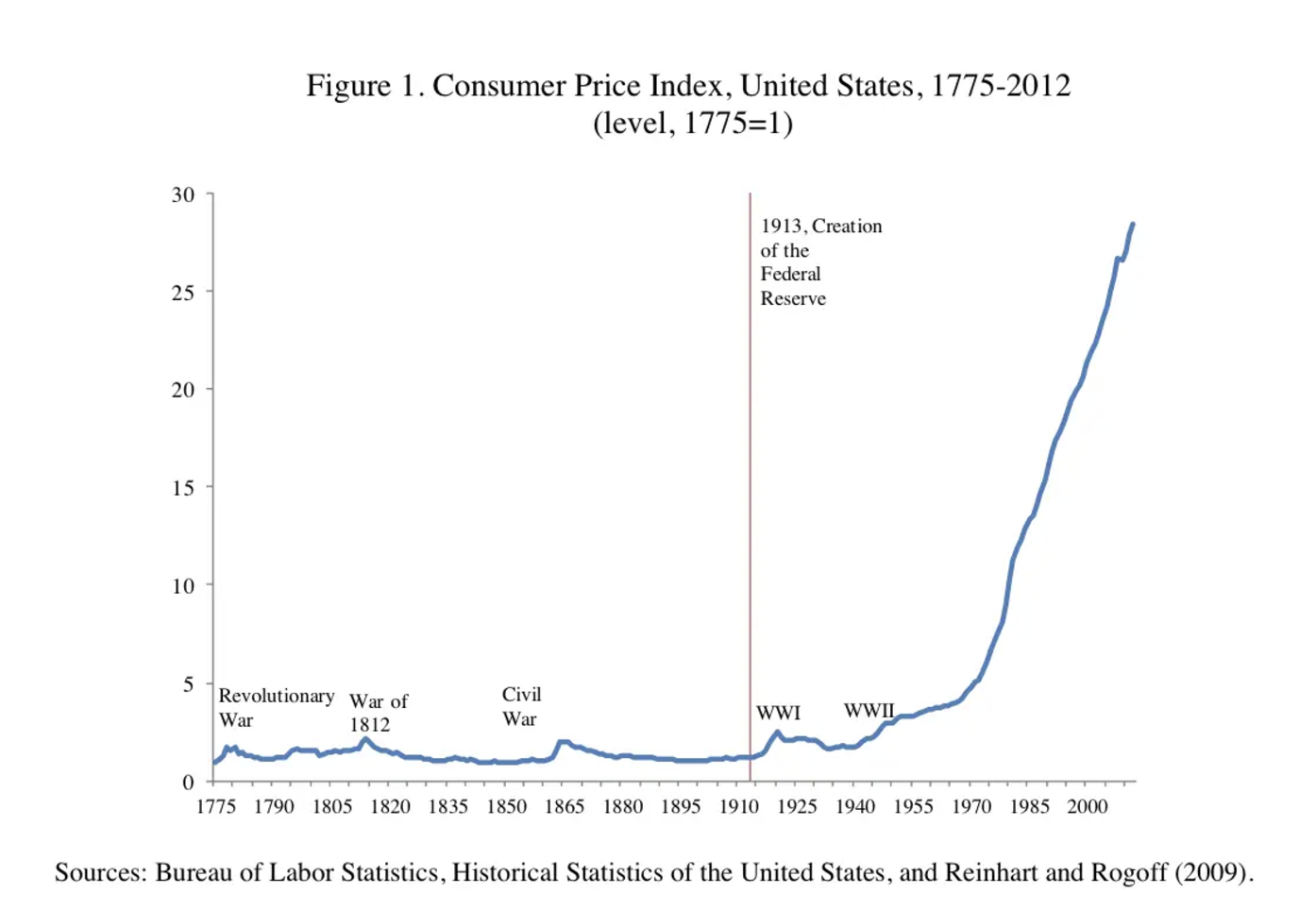

Holding cash (actual $100 bills) removes the counterparty risk you’re exposed to when you keep money in a bank and have to rely on that bank. That much is true. But dollars are notes. Notes are promises to pay. In the case of U.S. dollars, the Federal Reserve issues these notes and if you have some in your wallet, you have a promise from the Federal Reserve to pay you for those notes. Guess what they pay you with – other notes. The U.S. dollar is no longer backed by gold. Today's dollar is simply a written promise that entitles you to exchange it for other promises. You have the right to exchange two $10 bills for a $20 bill, or a $100 bill for ten $10 dollar bills, or whatever. They are only paper notes, as is all fiat currency. The U.S. dollar is actually referred to as a "note" on the front of the dollar itself, twice. Can you spot them both?

- First-class postage was 4 cents.

- A Coke was 10 cents.

- A gallon of gas was 31 cents.

- Tennis shoes were $5.

- A new car was $2,500.

Politicians will tell you that rising prices is the result of "corporate greed." They've redefined the word inflation to mean rising prices and blame inflation on those companies who increase their prices. This incorrect definition even shows up in modern dictionaries. But rising prices is not inflation. Prices don't "inflate." That's not even English. Prices rise. Rising prices is not inflation, it is the result of inflation. Here is how an old (1951) Webster's Dictionary properly defines inflation:

Claiming that rising prices cause inflation is like claiming that wet sidewalks cause rain. Inflation is caused by Federal Reserve increasing the money supply to cover overspending by our government. And the resulting loss of the purchasing power of our currency is a tax on us all.

"In the absence of the gold standard, there is no way to protect savings from confiscation through inflation" - Alan Greenspan, Federal Reserve Chairman

“I have seen a grievous evil under the sun: wealth hoarded to the harm of its owners, or wealth lost through some misfortune, so that when they have children there is nothing left for them to inherit.”

– Ecclesiastes 5:13-14

In summary: saving dollars is unwise. That said, there are are a few reasons to save some actual green cash: If you think your bank account may be frozen or confiscated by a creditor or the IRS. If you think you might need cash to purchase something from someone who refuses to accept a check or credit card. Heavy equipment auctioneers and precious metal/coin dealers often demand cash. If you don’t want a record or paper trail of a transaction. If you think you might get arrested and will need to make bail. If you are planning a trip. It's good to bring some cash with you when you travel, since you never know when there might be a problem with your credit card.

Cash money is not wealth. It's what we temporarily hold so that we can transfer wealth. Now, let’s move on to harder assets:

Antiques

Also, most antiques are considered to be wasting or depreciable assets. Assets have a useful life usually based on the period of time that they have productive capacity. Over time, antiques depreciate, eventually having little or no residual value. During the period of depreciation, the antique is called a "wasting asset" and is not subject to inheritance or capital gains tax.

And, finally, antiques can be bought, kept, and sold anonymously.

Nick’s Tips Regarding Antiques:

- Only buy antiques that are both authentic (not reconditioned) and undamaged.

- Many investment-grade antiques are made, either partially or completely, from precious metals. Therefore, an increase in the price of gold and silver will put additional upward pressure on the value of antiques that include these precious metals. Consider buying such antiques.

- In the future, people will accent their modern interiors with small antiques. So, choose antiques that don’t take up a lot of room. If it can't fit through a standard doorway, who would realistically ever buy it from you? Smaller is better, and also less expensive to store.

- Don’t cater to the ultra-rich by storing million-dollar Ming vases. Buy antiques that are in the upper-middle range of the market where most future antique buyers will be. Antiques in the $250-to-$15,000 range are in the sweet spot.

- You may want to enjoy your antiques in your home while you are storing them, using each piece as it was designed to be used. A future buyer will likely want to do similarly. So, curate a functional collection.

Guns

A rifle or pistol is an heirloom that can be passed on from generation to generation.

Anti-gun legislation often has the effect of increasing the value of the guns being regulated or banned. When there was talk of banning rifles like AR-15s and AK-47s, prices quadrupled and gun stores' inventories were depleted almost overnight. There is also nearly always a spike in gun sales after mass shootings for two reasons. Law-abiding citizens fear that government regulation will become stricter. Secondly, people buy guns for protection whenever a public shooting takes place.

Is it ethical to invest in guns? Billionaire Warren Buffett once answered that question by explaining that his personal political views should not enter into the investment choices he makes for Berkshire Hathaway, the $500 billion conglomerate he leads.

“I don’t believe in imposing my views on 370,000 employees and a million shareholders. I’m not their nanny on that.” – Warren Buffet

Even without Mr. Buffet’s blessing, with some 100 million unarmed people having been slaughtered by tyrants in the last century, I believe that guns are the ultimate social-responsibility purchase.

- Second Amendment activists,

- people concerned with self-protection,

- survivalists,

- hunters,

- collectors,

- gun sport enthusiasts,

- and investors.

- Obviously, clean your guns before storing.

- Keep guns safely locked up.

- Try to maintain a steady relative humidity in the room.

- Use gloves when handling or showing the guns to others.

Lots and Raw Land

Raw land is land in its natural state, with few or no man-made improvements. What makes something valuable, in part, is its rarity, and raw land is becoming more and more scarce every day. There simply is a limited quantity available on Earth, and they aren’t making any more of it. Land investors have very few competitors, unlike residential homes. You can often buy raw land at a discount if the seller wants a quick sale.

Do your homework (due diligence):

- How much are the property taxes? How much will they be after you buy the land?

- What are the zoning and permitted uses?

- Are accessory buildings permitted? Often, they are not unless there is already a primary residence on the property.

- What are the building height restrictions?

- Are there any covenants (restrictions)?

- What is the topography? Is it in a floodplain or does it contain a wetland?

- What utilities are available? Is there public water, sewer, gas, and/or electrical? What is the water tap fee?

- Are there any easements?

- Will you have public or deeded access to the property?

- Are there any contaminants or environmental concerns? Was there ever any industrial pollution or contamination on or near the property?

- Is it susceptible to wildfires?

- What is the soil type and what can it be used for? Is there topsoil?

- Does it come with mineral rights?

- Is or was there mining underneath?

- Look for ways to quickly generate income with the land. Leasing it to a nearby farmer or a hunter, or for self-storage, parking or billboards can provide some revenue to reduce carrying costs and “babysit” the land while you hold it.

- With vacant land, you don’t need to know or do anything. There's no construction, no renovations, no expertise, no maintenance.

- Talk to the neighboring property owners about the land.

- Look for elderly farmers who are retiring.

- View mature hardwood trees as a valuable asset.

- Look at its proximity to other desirable locations, such as schools and shopping.

- Purchase in the path of growth.

- Buy at the bottom of the market, during a recession, and then sell in the recovery.

- Avoid buying any property governed by a homeowners association (HOA).

Fine Art

Don’t do it. Art has no intrinsic value. It cannot be regularly marked up to some market price. There is no way of knowing what it is worth at any given moment. Buying art is gambling in an illiquid realm dominated by a handful of players who all likely know more than you do.Groceries and Staples

Nick and his stored potable water

Here are some supplies you should consider storing:- Energy bars

- Military MREs (Meals Ready to Eat)

- Canned goods

- Wheat (hard red)

- Rice (white rice stores longer than brown, but has fewer nutrients)

- Dried beans

- Dried lentils

- Oatmeal

- Corn (whole kernel)

- Peanut butter

- Dried fruit

- Honey (liquid/pure stores the longest)

- Sugar

- Canned sardines, tuna and salmon

- Cooking oil

- Olive oil

- Nuts

- Nut butter

- Powdered milk

- Vinegar

- Salt (large supply)

- Baking soda

- Nitrogen-packed food

- Freeze-dried food

- Ground coffee

- Vitamins

- Baby food

- Pet food

- Aluminum foil

- Paper towels

- Toilet paper

“Precious treasure and oil are in a wise man's dwelling.” – Proverbs 21:20

Nick’s Tips Regarding Food Storage:

- Buy in bulk to save as much as 80%. Can you buy stocks at an 80% discount?

- Store your food in a cool, dry place away from sunlight. A basement is ideal.

- Store what you eat and eat what you store.

- Rotate your stock.

Diamonds

Diamonds are a depreciating asset masquerading as an investment. When you buy a diamond, you buy it at retail, which is at a 100% to 400% markup! There are 4 trillion tons of diamonds in the world... 4 trillion tons! They aren’t rare and they don’t appreciate. In short, diamonds are bull crap. Fruit Trees

Fruit trees are an investment that requires an upfront cost and then some maintenance in the investment each year, but the maintenance costs generally go down quickly over time.

A decent 3-year old tree will cost you about $150. You'll need a pollinator, and so there is a minimum investment of two trees. During the first year, your trees will also need water to get established. So your initial investment including your labor and water will be around $600. After a couple years, your two fruit trees will be producing 150 pounds of fruit per year. Organic fruit costs about $1.50 per pound. So two fruit trees producing $225 worth of fruit a year will generate a 37% return on your initial investment.

Jewelry

Forget jewelry with one exception: jewelry where the bulk of the value of the jewelry is in the gold or silver used to make it. Then, you are merely storing gold in the form of jewelry, which is fine. Classic Cars

Storing classic cars as an investment usually requires three things (at a minimum): - a love for the model (nostalgia);

- the mechanical skills to maintain the car; and

- the room to store the car indoors.

Nick’s Tips Regarding Classic Cars:

If you are going to invest in a classic car, store it right. Here are some storage tips:

- Give the vehicle a good wash and wax. Putting on and removing a vehicle cover will lead to unwanted scratches if the car is dirty.

- Change the oil and filter.

- Fill the antifreeze.

- Fill the tires with nitrogen, not air. Nitrogen will allow the tires to last longer.

- Fill the fuel tank (preferably with premium) and add fuel stabilizer. The fuller the tank, the less room there will be for air, which carries moisture that can lead to fuel contamination and rust.

- Run the vehicle to move the fuel stabilizer into the carburetor.

- Put baking soda boxes in the interior and trunk.

- To keep out insects and vermin, put a plastic bag over the air cleaner/air inlet and exhaust pipe(s), or cover them with aluminum foil.

- Place mothballs in the tailpipe and around the outside of the car.

- Spray dry Teflon lube or silicone spray on all the weatherstripping to keep it from bonding to the doors.

- Close all the windows and doors.

- Select a dry, dark location with concrete flooring. If you must store your car on a dirt floor, place a plastic barrier under the vehicle, and place carpet pieces or plywood under the tires.

- Unhook the battery and store it separately – preferably, where it will not freeze.

- Place the vehicle on jack stands. This step stops the tires from getting flat spots and adds longevity to the suspension.

- Cover the vehicle with a breathable fabric (or just a cotton sheet) that doesn’t trap moisture.

Sports and Entertainment Memorabilia

Unless you are in the sports memorabilia business, it’s a very tough market to navigate, especially with dealers rigging auctions, bidding up their own items, tampering with collectibles, and forging signatures. Fraud is so common in the sports and entertainment memorabilia world that the entire industry has become a joke. And even if you could buy something authentic, like the collector who paid $3 million in 1999 for the home run ball that Mark McGwire hit, appreciation isn’t guaranteed. Now that McGwire admitted to using steroids, you'd be lucky to sell that ball for $100,000.

Stay away from memorabilia as an investment strategy.

Nick’s Tip for Investing in Memorabilia:

If you are procuring the autograph in person, take a picture of the celebrity signing the item with you in the background of the picture. This will provide provenance (evidence that the autograph is authentic).

Stamps

Unless you are an expert in this area, I would stay away from collectible and even investment-grade stamps. There is just too much to know. Furthermore, stamp collecting is a hobby of past generations.Nick’s Tip Regarding Stamps

The only investing in stamps that I recommend is buying U.S. Postal Service Forever Stamps just before they go up in price. For example, in January 2019, Forever Stamps went up 10% in one day, and they announced the day ahead of time.

Wine and Whiskey

I don't recommend investing in wine for the following reasons:- It requires some expertise.

- You have to store the wine correctly.

- You will probably want to insure it.

- Wine takes up a lot of space.

- Wine bottles break.

- Some wine spoils.

- Your investment might suffer loss from use (drinking it).

- You’ll likely have to wait a decade to see significant appreciation.

- Selling the wine at auction takes a lot of work and the auction house charges fees. Wine is liquid without liquidity.

- It’s not possible for whiskey to get too old. It may not be getting any better after a certain number of years, but it doesn’t get worse. The minimums are ten years for bourbon, and 20 years for scotch.

- Whiskey has an almost indefinite shelf life. As long as the bottle is kept out of direct sunlight, the Scotch Whisky will neither improve nor deteriorate, even if it is opened.

- And, in a survival situation, whiskey can be used as a combustible, a solvent, and a disinfectant.

- Drinking a little whiskey each day has several health benefits.

Nick’s Tip Regarding Whiskey

Store bottles upright, not on their side (like wine) - to protect the cork from the high-strength alcohol.

Old Paper Currency and Banknotes

Old notes can be a fairly good investment. The pricing of paper currency and banknotes is more stable than old coins because unlike old coins, paper isn't affected by the fluctuations in precious metals like coins are. Paper notes are also beautiful. They are works of art. And they don't take up much room to store. The problem with old notes is that they are easy to counterfeit. In fact, they were often counterfeited back in the year they were released. Because of counterfeiting, you should only buy graded notes. Paper currency grading is the process of determining the grade or condition of a bank note, one of the key factors in determining its value. I would even say that the grade isn't as important as it being graded. Being graded, regardless of the grade, at a minimum verifies that the note is authentic.

Visit Nick's Paper Currency and Banknote collection.

Cryptocurrencies

Pros:

- Many cryptocurrencies are decentralized. They don’t collapse at a single point of failure.

- They are somewhat anonymous.

- You can fly anywhere with access to your cryptocurrency.

- It is easy and fast to transfer between parties around the world.

- It is an easy asset to hide from creditors.

- Some cryptocurrencies such as Bitcoin are deflationary in that the limited number of them will ultimately begin to decrease forever as passwords are lost accidentally or upon a death.

- Inflation protection. Governments can’t print them.

Cons:

- Price volatility.

- It takes a lot of energy to mining for cryptocurrencies and that is bad for the environment.

- It takes a lot of energy to transact in cryptocurrencies. For example: One Bitcoin transaction uses as much energy as it takes to power the average American home for 6 weeks. Using Bitcoin isn't just expensive, it's unconscionable.

- They are backed by nothing. Someone makes them up on their computers.

- They have a short 14-year history as money or a store of wealth.

- They are not supported by the banking system.

- They are not an investment in a productive, profitable company. It’s speculation.

- You are speculating that someone in the future will pay more for your cryptocurrency than you bought it for. And of course that buyer has to be of the belief that he/she can one day sell it for more than they paid you for it. They only goes up and down based on demand.

- They are competitor to the government’s currency which makes it a target for regulation and even prohibition.

- Market manipulation by large players.

- You can lose access to all of your cryptocurrency if you lose your passwords.

- Transactions can’t be reversed.

- Transactions do not come with legal protections.

- Counterparty risk.

- A lot of cryptocurrency is held in exchanges like FTX which could steal from you.

- They are not widely accepted by many merchants.

- Digital transactions leave a trail. In early 2022 the U.S. Department of the Treasury confiscated a whopping 3.1 billion dollars worth of cryptocurrencies across numerous platforms from people around the world. This not only proves the government can find your cryptocurrencies, but that they also have no problem taking them without due process.

- Cryptocurrencies aren’t scarce. There are 23,000 different cryptocurrencies and this number keeps growing. Anyone can make their own. Would you invest in a business that had thousands of competitors?

- Cryptocurrency promotors spend millions on advertising. They are running a "Gold is dead" TV ad promoting Bitcoin. And FTX recently paid $130 million to put its name on the Miami-Dade County Sports Arena. Where is all that money coming from? Cryptocurrencies don't produce anything to make money to pay for advertising.

- Central banks are launching their own digital currencies to compete with the existing ones.

- Calculating the capital gains tax owed each year is a nightmare.

- A solar flare could shut down the internet and destroy cryptocurrency records instantly.

Cryptocurrencies are pure speculation, only. I can only think of one use for cryptocurrencies and that is to transfer money across national borders or to move your wealth with you to a different location. I suppose if Jews who were escaping WWII Germany had access to cryptocurrencies, they would have used it instead of sewing gold into the insides of their coats.

And on that note, we come to precious metals.

Silver and Gold

I saved the best for last. In my opinion, the best store of wealth are silver and gold, and here is why:- Markup

You pay a premium when you buy silver or gold, but it is relatively small compared to anything else you buy in life. Costco, at 15%, has the lowest markups of any retail store in America. Their margin is often described as “razor thin.” Silver and gold have premiums of half of that (around 7%). If you buy right and in any serious quantity, you can often get that premium down under 3%. - Storage

Both are compact (albeit heavy) stores of value. Gold, however, is worth significantly more per ounce than silver and it is also the denser of the two metals, making the volume of gold worth far more than an equal volume of silver. - Indestructibility

Silver and gold – especially gold – are nearly indestructible and will last thousands of years. If you are storing gold in your home and your home burns to the ground, your gold melts into gold. - Difficult to Counterfeit

Gold in particular is difficult to counterfeit because it is one of the heaviest metals. Fake bars can be detected by simply measuring their specific gravity. - Transportability

It’s easier to transport gold than silver, but both can be moved and shipped easily. Silver and gold coins and bars are regularly shipped when bought and sold. - Fungibility

Silver and gold are considered 100% fungible in that one ounce of silver or gold anywhere in the world is worth what every other ounce is worth. - Market Price

It’s a simple matter to look up the value of any silver or gold coin or bar without a professional appraiser. Prices are always available online in real time. - Divisibility

Both silver and gold are easily divisible. You can buy and sell gold dust or gold bars. Both are used in coin money and come in multiple denominations. - Used in Jewelry

Both silver and gold are used in making jewelry. - Stored by Central Banks Around the World

Central banks don't store $100 bills or diamonds in their vaults. They store gold. - Gold is Tier 1 Capital

Tier 1 capital is the most perfect form of a bank's capital. It's part of the reliable money the bank has stored to keep it functioning. Gold is considered to be Tier 1 capital. - Used in Industry

Both silver and gold are used in industry. Silver is a good electrical conductor and has the highest thermal conductivity of any metal. Silver is used to make solder, silverware, solar panels, media storage, and batteries. Gold is used in dentistry, cell phones, computers, medicine, architecture, and satellites. Gold is so malleable that NASA covers the visors of their astronaut's helmets with a see-through layer of it to fend off dangerous effects of solar radiation. - Liquidity

Both gold and silver are extremely liquid assets. When you are ready to unload some metal, you can sell it at virtually any pawn shop, coin store, jewelry shop, on eBay, or to individuals. The gold and silver markets are about as liquid as it gets, so you never have to worry about getting stuck with either. - Scarcity

Silver and gold are scarce. They are both hard to find and getting harder to find and more expensive to mine every day. All the gold ever mined in all of human history could fill only about two Olympic-size swimming pools. There is even less silver than gold. - History

For thousands of years, silver and gold have been used for monetary exchange. All civilized nations recognize gold as the number-one standard of value. Central banks around the world don’t store diamonds... they store gold. As Chief Global Strategist for Euro-Pacific Capitol said:

"Gold has worked for thousands of years, but now, with the Internet, it works even better." – Peter Schiff

- Legitimacy

"No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility."- Article I, Section 10, Clause 1, U.S. Constitution. - Anonymity

You can buy and sell silver and gold for cash. There is no state, province, or country that requires its citizens to report their silver or gold holdings. - Beauty

Silver and gold – especially gold – are unbelievably beautiful. - One more

Gold's competitor, the U.S. dollar, has recently been weaponized by President Joe Biden. Biden put other nations on notice that if they do or say something America doesn't like, he will use the dollar's status as the world's reserve currency to harm them. He even confiscated other nations' dollars. This has caused the world to seek to de-dollarize and turn to gold as a safer store of wealth.

My personal advice for investing in gold is to buy pre-1933 U.S. coins in any denomination. This provides a smidgen of numismatic value and some additional demand simply because they are old, while still maintaining their minimum melt value.

"Gold is money. Everything else is credit." – J.P. Morgan

Prepare

“Let Pharaoh appoint commissioners over the land to take a fifth of the harvest of Egypt during the seven years of abundance. They should collect all the food of these good years that are coming and store up the grain under the authority of Pharaoh, to be kept in the cities for food. This food should be held in reserve for the country, to be used during the seven years of famine that will come upon Egypt, so that the country may not be ruined by the famine.” – Genesis 41:34-36

The U.S. government ran up a $35 trillion debt. They wasted $9 trillion waging the longest two wars in U.S. history on the wrong two countries. We must never forget... never forget that not a single 9-11 hijacker, mastermind, or financier was Afghan or Iraqi. Not one. Our government has nothing saved for us. Therefore, each of us individually must store our own grain.

Jesus was sentenced to death. Then next worse thing is to be given a life sentence. Imagine this. You’ve committed no crime and you haven’t been found guilty of anything. Yet the judge sentences you, and the punishment is horrific:

“The court hereby orders that you work until you physically can’t work any more, without possibility of parole. This may mean you must labor for years, decades, or even the rest of your entire life. And at the end of serving your sentence, the court orders that you have no more assets than when you began serving your sentence.”

Don’t work for years and end up with nothing to show for it. No one cares that you once had a lot of chips in the middle of a poker game. What you have at the end of your career is what matters.

If you found this article useful, make a modest donation to Cozy Coats for Kids and follow me on Twitter at: https://twitter.com/gromicko

The Four Most Common Ways Inspectors Get Rich

Asset Protection for Inspectors

The Story of Motel 6, or Why Home Inspectors Should Store Wealth

Emergency Preparedness

Pricing and Billing for Home Inspectors

How to Quadruple Your Inspection Business in Two Years

Paying a Little Extra for an InterNACHI® Inspector Pays Off

How to Use the Power of Your Certified Master Inspector® Professional Designation to Boost Your Inspection Business

Inspection Business Success Strategies

Why Home Inspectors Need Social Media to Be Successful

InterNACHI's Member Marketing: Free Designs for Members

Download your free copy of STACKS: A Home Inspector’s Guide to Increasing Gross Revenue.

Download your free copy of SLEEP WELL: A Home Inspector’s Guide to Managing Risk

BizVelop: Free Business Development Tool for Home Inspectors